Over the last few days, a new and controversial Resolution issued by the Central Bank of Cuba (BCC) under the title 111/2023 has grabbed much attention in the Cuban media. This followed the announcement by the Ministry of Trade of a set of measures that will operate in the retail sector and the use of cash for both economic actors and natural persons.

The goal, according to its enforcers, is to eliminate the use of cash in domestic commerce by reversing the effect caused by the excessive circulation of cash outside the national banking system. The measure related to banking services access is called in Spanish Bancarización, and while it will become more noticeable with the new acceleration of its processes, it is actually part of a process that has long been part of the country’s economic agenda.

What does Bancarización in Cuba consist of?

Bancarización in Cuba is defined as the use of the financial system’s means of payment by individuals or companies to complete commercial transactions. In this way, banks can be assured of having the necessary solvency to perform their regular operations and to avoid excessive cash flows.

How does this work in Cuba?

The following actions are effective as of 3 August 2023 and are part of the increased bankability of operations:

- All economic agents must request the cash they need for their activity at the bank branches where they operate their current and tax accounts.

- Enable the use of ATMs only for natural persons dispensing their pensions, salaries, or cash from their savings account, etc.

- Priority is given to the use of electronic media and channels, whenever possible. Transactions between economic agents shall be executed by means of negotiable instruments or other means; under no circumstances shall such transactions be performed in cash.

- Creating the conditions in all businesses and service providers to enable electronic means of payment is a priority. All of these with their established discounts, which can be attractive for the population to opt for these payment methods.

Some facts about the process of bankarisation according to renowned Cuban economists

- In the country there is a need to achieve increasing levels of banking penetration in relation to the low levels that currently exist.

- Banking in Cuba provides security, efficiency and savings, transparency, immediacy, payment capacity and permanent operation.

- Before the measure, the decrease in the availability of cash in the national banking system was already evident, which hindered it from fulfilling part of its functions and guaranteeing cash to the population and companies.

Acceptance of the resolution

The debate has quickly captured the media’s attention and now occupies the attention of the population, which has many doubts about the functioning of such determinations.

More than a few economists have pointed to the government’s questionable ability to use these measures to mask the effect of a financial and production crisis that dates back more than a decade. They also question other factors influencing the initiation of a forced process of bankarisation and whether the current context will allow the measures to have any positive effect.

There is a kind of general feeling that the timing of the measure is inconvenient, with users who have commented on social networks and digital media pointing to parallels with the failed economic order. The resolution comes in a context of increasing devaluation of the national currency, deep shortages and insufficient domestic production. In both cases, conditions were not in place to reduce potential negative impacts.

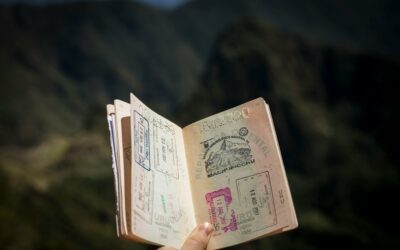

About Us

Opapeleo is your procedures agency 100% online or by phone We are in Washington DC 150 meters away from the Cuban Consulate. We provide services for the Extension and Renewal of Cuban passport, Legalisations, Powers of attorney on all kinds, Authorisations for minors to leave the country, DVT, Visas to Cuba, Top-ups, applications for Cuban certificates, delivery of official documents and all kinds of procedures related to Cuba.